6672

0

3 Stocks To Buy From Warren Buffet’s Portfolio - T-Mobile

3 Stocks To Buy From Warren Buffet’s Portfolio - T-Mobile ; 3 Stocks To Buy From Warren Buffet’s Portfolio - T-Mobile

Yazar: Zack Smith

Yayınlanma: 22 Mart 2021 10:56

Güncellenme: 2 Mart 2026 15:52

3 Stocks To Buy From Warren Buffet’s Portfolio - T-Mobile

3- T-Mobile

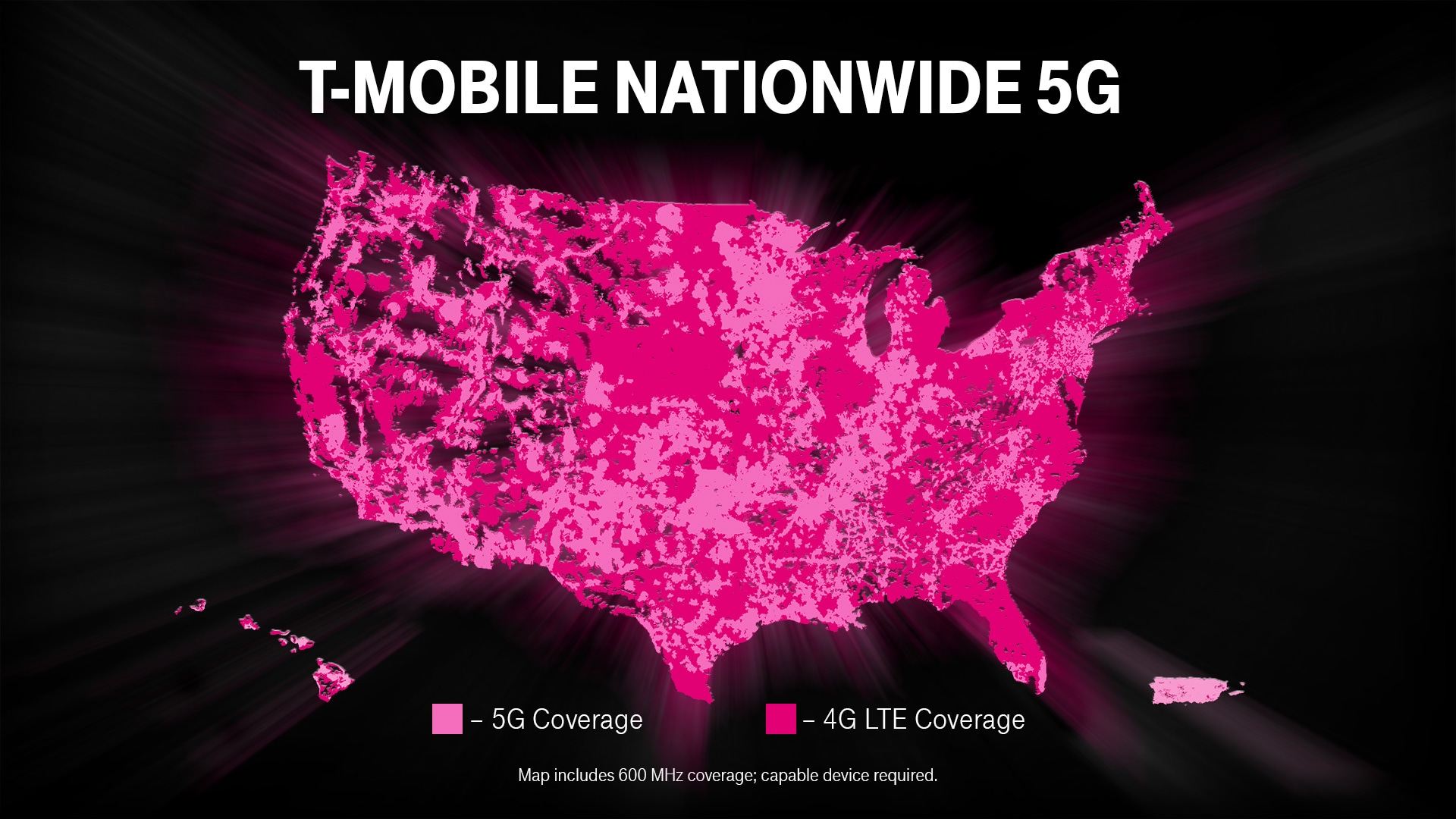

T-Mobile is a company that provides state-of-the-art wireless 5G service widely throughout the US. Only T-Mobile, AT&T and Verizon provide this service nationwide. T-Mobile has long achieved competitive earnings without compromising on lower prices and quality. After acquiring Sprint, it gained significant momentum in the market by gaining both customer base and customer diversity.T-Mobile now controls about 29 percent of the market, according to Evercore.

Licensed spectrum providing control of a frequency in a specific geographic area resulted in more wireless coverage.

T-Mobile had problems with commercial customers during this time, who tended to place more emphasis on quality.

Thanks to additional spectrums and external spectrum purchases from Sprint, T-Mobile can now improve service quality, possibly eliminating problems with high-end customers.

Licensed spectrum providing control of a frequency in a specific geographic area resulted in more wireless coverage.

T-Mobile had problems with commercial customers during this time, who tended to place more emphasis on quality.

Thanks to additional spectrums and external spectrum purchases from Sprint, T-Mobile can now improve service quality, possibly eliminating problems with high-end customers.

Despite this challenge, T-Mobile continues to profit.

T-Mobile added 5.6 million additional networks in 2020. It was a very good move, at a time when AT&T was adding 1.6 million wireless networks and Verizon was experiencing customer losses. The cash flow of the company remains critical, given the massive investments it has made in spectrum and equipment to build a 5G network. T-Mobile spent nearly $11 billion on property and equipment in 2020. Although AT&T and Verizon spent a lot of money in this area, there was no significant decrease in their cash flows.However, T-Mobile cannot compete with Verizon or AT&T in generating cash flow!

T-Mobile generated free cash flow of $3 billion in 2020, while AT&T generated $27.5 billion and Verizon generated $23.6 billion of free cash flow.Unlike its competitors, T-Mobile does not pay dividends. However, that didn't stop T-Mobile shares to rise 65 percent last year.

This is a significant increase that came at the time of the 10 percent Verizon and 5 percent AT&T drop in the same period. Considering Verizon generates 4.5 percent cash returns and AT&T 7 percent, T-Mobile performance shows us why Buffett kept its stock despite the lack of dividends.

If T-Mobile continues to put pressure on its competitors in both price and quality, the momentum it has created can easily continue.

3 Stocks To Buy From Warren Buffet’s Portfolio - T-Mobile

Source: https://www.fool.com/

You may also be interested in:

Considering Verizon generates 4.5 percent cash returns and AT&T 7 percent, T-Mobile performance shows us why Buffett kept its stock despite the lack of dividends.

If T-Mobile continues to put pressure on its competitors in both price and quality, the momentum it has created can easily continue.

3 Stocks To Buy From Warren Buffet’s Portfolio - T-Mobile

Source: https://www.fool.com/

You may also be interested in:

3 Stocks To Buy From Warren Buffet’s Portfolio – StoneCo

İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...