1697

0

Warren Buffett-3 Stocks Warren Buffett Made At Least 20 % Yield

Warren Buffett's success is mostly attributed to his selection

Yazar: Ross Sutton

Yayınlanma: 8 Nisan 2021 19:53

Güncellenme: 21 Şubat 2026 19:45

Warren Buffett

-3 Stocks Warren Buffett Made At Least 20 % Yield

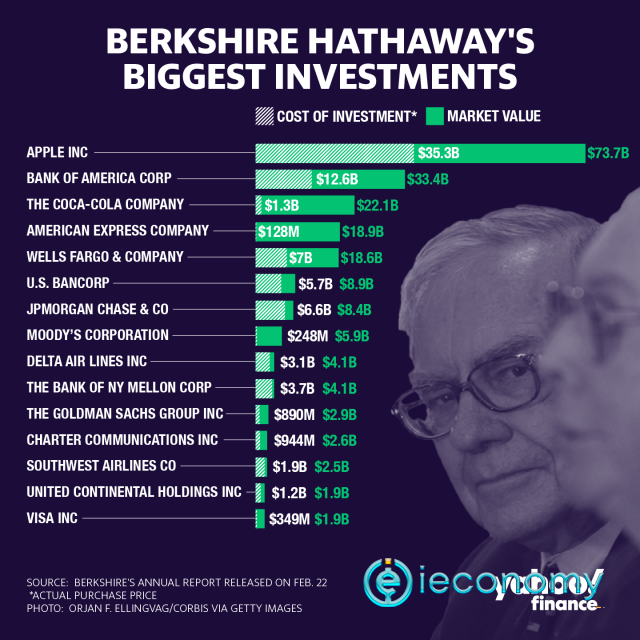

Warren Buffett- 3 Stocks Warren Buffett Made At Least 20 % Yield Warren Buffett's success is mostly attributed to his selection Berkshire Hathaway has been generating an average annual return of 20 % for its shareholders since 1965. This means that investors' shares have doubled on average every 3,6 years since 1965. It is also proof that Berkshire shares have historically far exceeded other investment firms. Dividend stocks played a key role in Buffett's success Warren Buffett's success is mostly attributed to his selection of companies with sustainable competitive advantages and his willingness to continue their investments for a long time. What is often overlooked in success stories is the role dividend shares play. Companies that pay regular dividends are generally profitable and have time-tested operating models. This is exactly what Buffett was looking for in a job. By holding successful dividend shares in the long run, Buffett was able to generate a high return on the cost basis of Berkshire Hathaway. According to the data shown; Buffett's company will earn more than $ 5 billion in dividend income in 2021. Buffett earns more than 20 % annually from these long-term holdings. Buffett's patience with the following three stocks generated an annual return of 20 % to 52 %, based on Berkshire Hathaway's initial cost basis. Coca-Cola: 52 % annual return on an initial cost basis Beverage giant Coca-Cola (NYSE: KO) has been in Berkshire's investment portfolio for 33 years. Coca-Cola will raise its base annual dividend to $ 1.68 for the 59th consecutive year in February, while Buffett and his team will collect a 52 % return in 2021. What makes Coca-Cola such a special stock is the combination of geographic reach and superior marketing. In terms of reach, the company operates in every country in the world except North Korea and Cuba. Having 20 % of the cold drink market share in developed markets and 10 % in fast-growing markets, the company has at least 20 brands with annual sales of $ 1 billion or more. Coca-Cola is also very successful in marketing. The company has succeeded in passing from generation to generation with its willingness to advertise in print media, television and radio as well as social media. Coca-Cola will never surprise Wall Street with its growth rate. As long as Buffett is in charge of Berkshire Hathaway's investment portfolio, Coca-Cola is unlikely to be sold, earning the trust of investors. Moody's: 25 % annual return on a first cost basis Another star dividend share of Warren Buffett, and perhaps one of the biggest investments of all time, is credit rating agency Moody's (NYSE: MCO). Berkshire Hathaway has owned Moody's shares since leaving Dun & Bradstreet in 2000. The company provides Buffett and his team with an annual return of about 25 %. Even if a slowdown in debt issuance is expected in 2021, the segment should still generate sales and profits above historical norms. Banks have begun to rely on Moody's to reduce both local and international risks. American Express: 20 % annual return on a first cost basis Buffett has kept financial services company American Express (NYSE: AXP) in Berkshire's portfolio since 1993. American Express is expected to bring an annual return of 20 % to Buffett's company in 2021. The beauty of American Express's business model is that long-term investors are almost sure of what they will win. The thing is, recessions are usually measured in months, while economic expansion lasts for years, maybe even more than a decade. American Express also has a serious knack for attracting wealthy customers. These wealthy customers and the wages they pay play a big role in increasing the company's profits. As with Coca-Cola, Buffett has no incentive to part ways with its AmEx stock. Warren Buffett- 3 Stocks Warren Buffett Made At Least 20 % YieldSource: The Motley Fool

You may also be interrested in:

4 Dow Jones Shares Available In April

İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...