7799

0

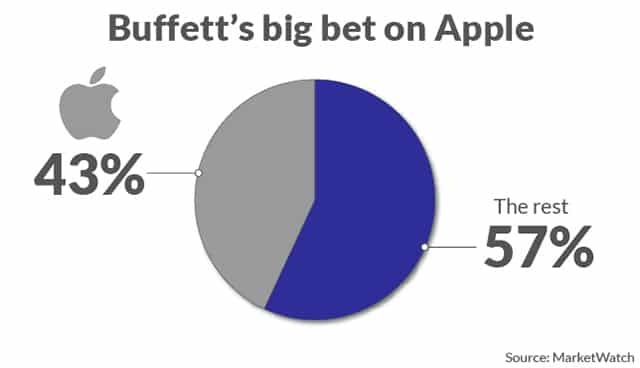

43 percent of the Berkshire Hathaway Portfolio consists of a single stock

One of the richest people in the world, Warren Buffett; Almost half of the portfolio of Berkshire Hathaway, where it is the biggest shareholder and

Yazar: Müzeyyen D

Yayınlanma: 10 Temmuz 2020 16:17

Güncellenme: 18 Şubat 2026 19:04

43 percent of the Berkshire Hathaway Portfolio consists of a single stock

One of the richest people in the world, Warren Buffett; Almost half of the portfolio of Berkshire Hathaway, where it is the biggest shareholder and CEO, now consists of a single share.

Berkshire currently has more than $ 91 billion in Apple shares, representing 43% of the holding's entire portfolio.

Warren Buffett once said, "Diversification is protection against ignorance. It makes little sense if you know what you are doing."

Apparently, this is true even if the subject is technology stock.

When we take a look at the recent events of Berkshire Hathaway's portfolio of BRK.A, -1.10% BRK.B, -1.32% 214 billion dollars, we understand how much stock Berkshire has accumulated in Apple AAPL,% + 0.35

According to the numbers stated by Motley Fool, Buffet owns the iPhone manufacturer, which makes up 43% of the Berkshire cake, worth $ 91 billion.

As the report notes, there are 46 securities in the portfolio. When all of them are added, holding number -2, except Bank of America- BAC, -1.42%. They are not equal to the Apple stock, which proves how late the big tech names are on the stock market and how far they've been.

As the report notes, there are 46 securities in the portfolio. When all of them are added, holding number -2, except Bank of America- BAC, -1.42%. They are not equal to the Apple stock, which proves how late the big tech names are on the stock market and how far they've been.

Earlier this year, Buffett explained to CNBC how important Cupertino, Calif-based technology giant is for Berkshire's overall performance and said, "I don't think of Apple as a stock. I see this as our third business." he used expressions.

Berkshire also said that all its subsidiaries have made Geico and BNSF the iPhone maker and said, "This is probably the best job I know in the world."

Buffett's Apple position dropped slightly during Tuesday's trading session, but still outperformed the wider market, Dow Jones Industrial Average DJIA, -1.38%, S&P 500 SPX, -0.56 and tech-weighted Nasdaq Composite COMP, + 0.52% all had a very low course.

Earlier this year, Buffett explained to CNBC how important Cupertino, Calif-based technology giant is for Berkshire's overall performance and said, "I don't think of Apple as a stock. I see this as our third business." he used expressions.

Berkshire also said that all its subsidiaries have made Geico and BNSF the iPhone maker and said, "This is probably the best job I know in the world."

Buffett's Apple position dropped slightly during Tuesday's trading session, but still outperformed the wider market, Dow Jones Industrial Average DJIA, -1.38%, S&P 500 SPX, -0.56 and tech-weighted Nasdaq Composite COMP, + 0.52% all had a very low course.

As the report notes, there are 46 securities in the portfolio. When all of them are added, holding number -2, except Bank of America- BAC, -1.42%. They are not equal to the Apple stock, which proves how late the big tech names are on the stock market and how far they've been.

As the report notes, there are 46 securities in the portfolio. When all of them are added, holding number -2, except Bank of America- BAC, -1.42%. They are not equal to the Apple stock, which proves how late the big tech names are on the stock market and how far they've been.

Earlier this year, Buffett explained to CNBC how important Cupertino, Calif-based technology giant is for Berkshire's overall performance and said, "I don't think of Apple as a stock. I see this as our third business." he used expressions.

Berkshire also said that all its subsidiaries have made Geico and BNSF the iPhone maker and said, "This is probably the best job I know in the world."

Buffett's Apple position dropped slightly during Tuesday's trading session, but still outperformed the wider market, Dow Jones Industrial Average DJIA, -1.38%, S&P 500 SPX, -0.56 and tech-weighted Nasdaq Composite COMP, + 0.52% all had a very low course.

Earlier this year, Buffett explained to CNBC how important Cupertino, Calif-based technology giant is for Berkshire's overall performance and said, "I don't think of Apple as a stock. I see this as our third business." he used expressions.

Berkshire also said that all its subsidiaries have made Geico and BNSF the iPhone maker and said, "This is probably the best job I know in the world."

Buffett's Apple position dropped slightly during Tuesday's trading session, but still outperformed the wider market, Dow Jones Industrial Average DJIA, -1.38%, S&P 500 SPX, -0.56 and tech-weighted Nasdaq Composite COMP, + 0.52% all had a very low course.İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...