8330

0

CBRT's Interest Rate Decision Analysis from Bloomberg

CBRT's Interest Rate Decision Analysis from Bloomberg ; The Central Bank of the Republic of Turkey, on behalf of the strength

Yazar: Zack Smith

Yayınlanma: 21 Ocak 2021 20:59

Güncellenme: 3 Mart 2026 03:35

CBRT's Interest Rate Decision Analysis from Bloomberg

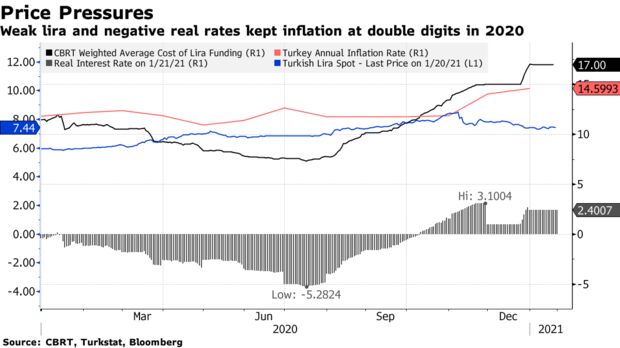

The CBRT kept the benchmark interest rate unchanged at the first monetary policy meeting of the year, after two successive rate hikes to combat inflation. The Monetary Policy Committee dropped the key interest rate at 17 percent on Thursday (today), in line with forecasts by most analysts in the Bloomberg poll.Many analysts, including economists at Morgan Stanley and Societe Generale SA, had predicted a 50 to 100 basis point increase.

The Central Bank stated that it will keep its tight monetary policy for a long time.

Central Bank President Naci Ağbal has increased the indicator by 675 basis points since he took office in November, in order to increase the inflation-adjusted rates even higher than the returns offered by the rising market peers. The bank's decisions to simplify the financing structure and to end unannounced foreign exchange interventions by state banks earned him enough credit to avoid another rate hike despite the spike in inflation last month."We don't see a fundamental reason for higher rates," JPMorgan Chase & Co analysts, including Yarkin Cebeci (JP Morgan Turkey's Chief Economist), wrote in a report citing high central bank credibility and a stable lira..

Cebeci expects the next step to be a 100bp cut in the second quarter, but the exact timing of this cut depends on relatively weaker domestic demand and inflationary pressures and a stable local currency.Turkey's key interest rate has been set by one of the world's highest inflation rates.

The Treasury and Finance Ministry's $ 3.5 billion Eurobond sale, which took place on weekdays prior to the central bank meeting, also supported analysts' interest estimates. Evren Kırıkoğlu, an independent market strategist based in Istanbul, said, "If policy makers were considering an interest rate hike, they could choose to issue debt after a decline in exchange rates and risk premium following the exchange rate decision."Erdogan Factor

Investors remain skeptical about the promise to follow normalization (orthodox policy) policies after Berat Albayrak, the son-in-law of President Recep Tayyip Erdogan and also Minister of Treasury and Finance, resigned in November. During Albayrak's reign in Turkey, banks drastically lowered borrowing costs while restricting Turkish lira trade with international organizations. It triggered $ 34 billion of foreign capital outflow from Turkish stocks and government bonds. Turkey's President Erdogan's criticism of the high interest rates last week provided further ammunition to skeptics. He reiterated the unorthodox economic hypothesis as high interest rates are the cause of inflation. Turkey's central bank fails to achieve the 5 percent inflation target since 2012. Consumer inflation climbed to 14.6 percent in December, beating even the central bank's rising forecast.

A weak lira and rapid loan growth, driven by negative real interest rates, kept the price increase in double digits in 2020. High levels of inflation tend to turn Turkish consumers into dollar assets to protect their savings.

Turkey's central bank fails to achieve the 5 percent inflation target since 2012. Consumer inflation climbed to 14.6 percent in December, beating even the central bank's rising forecast.

A weak lira and rapid loan growth, driven by negative real interest rates, kept the price increase in double digits in 2020. High levels of inflation tend to turn Turkish consumers into dollar assets to protect their savings.

In 2020, foreign currency deposits of residents in Turkey increased by 22 percent compared to the same period of the previous year reached about 235.7 billion dollars.

Strong demand for the dollar weakens the lira, creating additional inflationary pressure.

CBRT's Interest Rate Decision Analysis from Bloomberg Source: https://www.bloomberg.com/ You may also be interested in:European Central Bank’s Interest Rate Decision Will Be Announced Today

İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...