2606

0

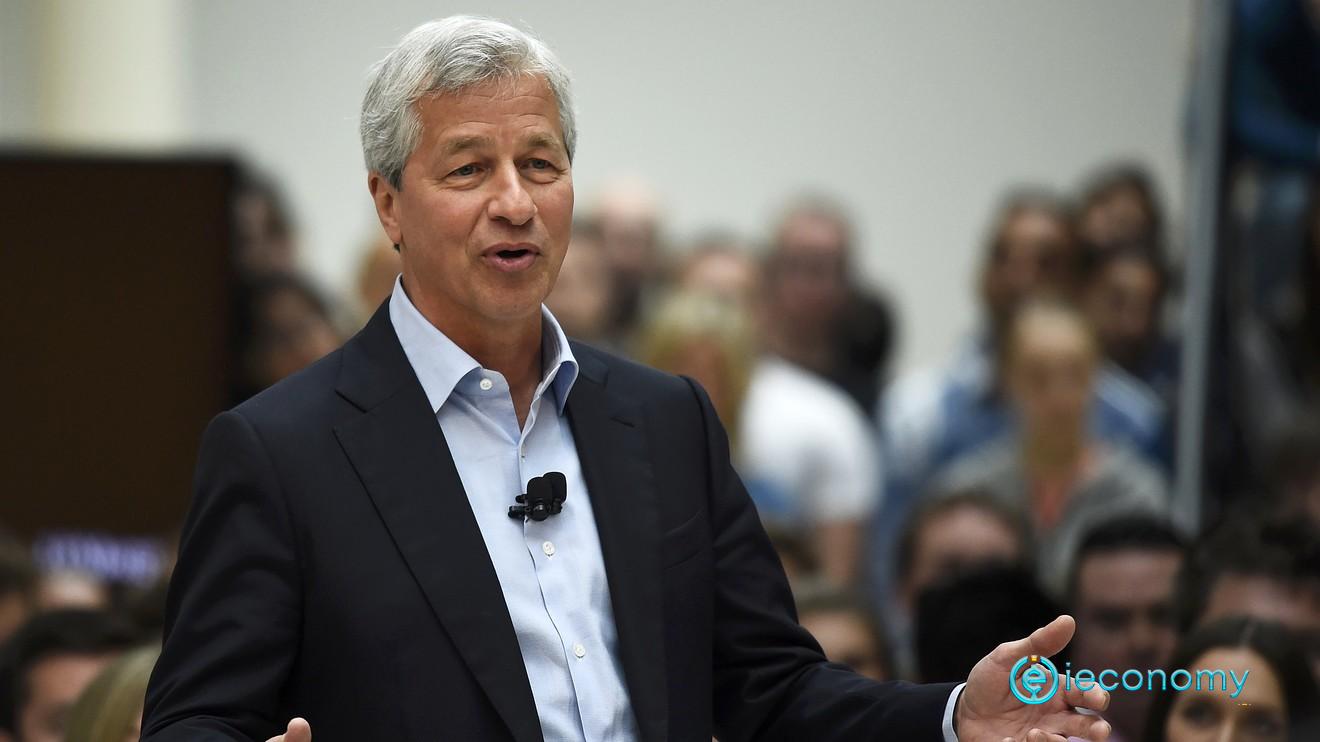

Dimon: Trying To Predict Market Peaks And Bottoms Is A Game Of The Losers!

Dimon said in a post on Wednesday: "Investment must be a permanent thingDimon said in a post on Wednesday: "Investment must be a permanent

Yazar: Ross Sutton

Yayınlanma: 23 Nisan 2021 16:48

Güncellenme: 3 Mart 2026 10:12

Dimon:

Trying To Predict Market Peaks And Bottoms Is A Game Of The Losers!

Dimon: Trying To Predict Market Peaks And Bottoms Is A Game Of The Losers! JPMorgan Chase (JPM) CEO Jamie Dimon says trying to predict the timing of the stock market highs and lows is "the game of the losers." Dimon said in a post on Wednesday: "Investment must be a permanent thing. Save and invest. Predicting the peaks and troughs of the market is exactly a loser game." I've never seen anyone win this way before. Warren Buffett, the smartest investor in the world, would also say that this is not a good way to invest. " Stating that he has given this investment advice for a long time, the bank CEO said, "Invest, be very careful about what you are doing, think about your retirement needs and such things. Everyone might need some help to do this. " Emphasizing that he hates trying to predict the stock market, Dimon said, "The boom economy will justify today's prices," and said, "There are bubbles out there." Dimon, who did not give any names, said that people were speculating and did not know why.Dimon said in a post on Wednesday: "Investment must be a permanent thing.

Not wanting to comment too much on stocks, CEO said he hadn't seen a correction anytime soon, indicating enthusiasm for growth and people returning to work. At the same time, Dimon warned that the markets tend to surprise, saying that the worst-case scenario for the market right now would be that "inflation will rise much faster than people think". "The Fed is moving faster than people think. In such a situation, stock prices would be too high." Dimon reiterated his optimistic views in his annual letter to JPMorgan shareholders that predicted a boom for the US economy.Source: Yahoo.Finance

You may also be interested in:

FAANG Stocks -General Status of FAANG Stocks

İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...