10976

0

Chinese industrial companies raised their prices sharply in October

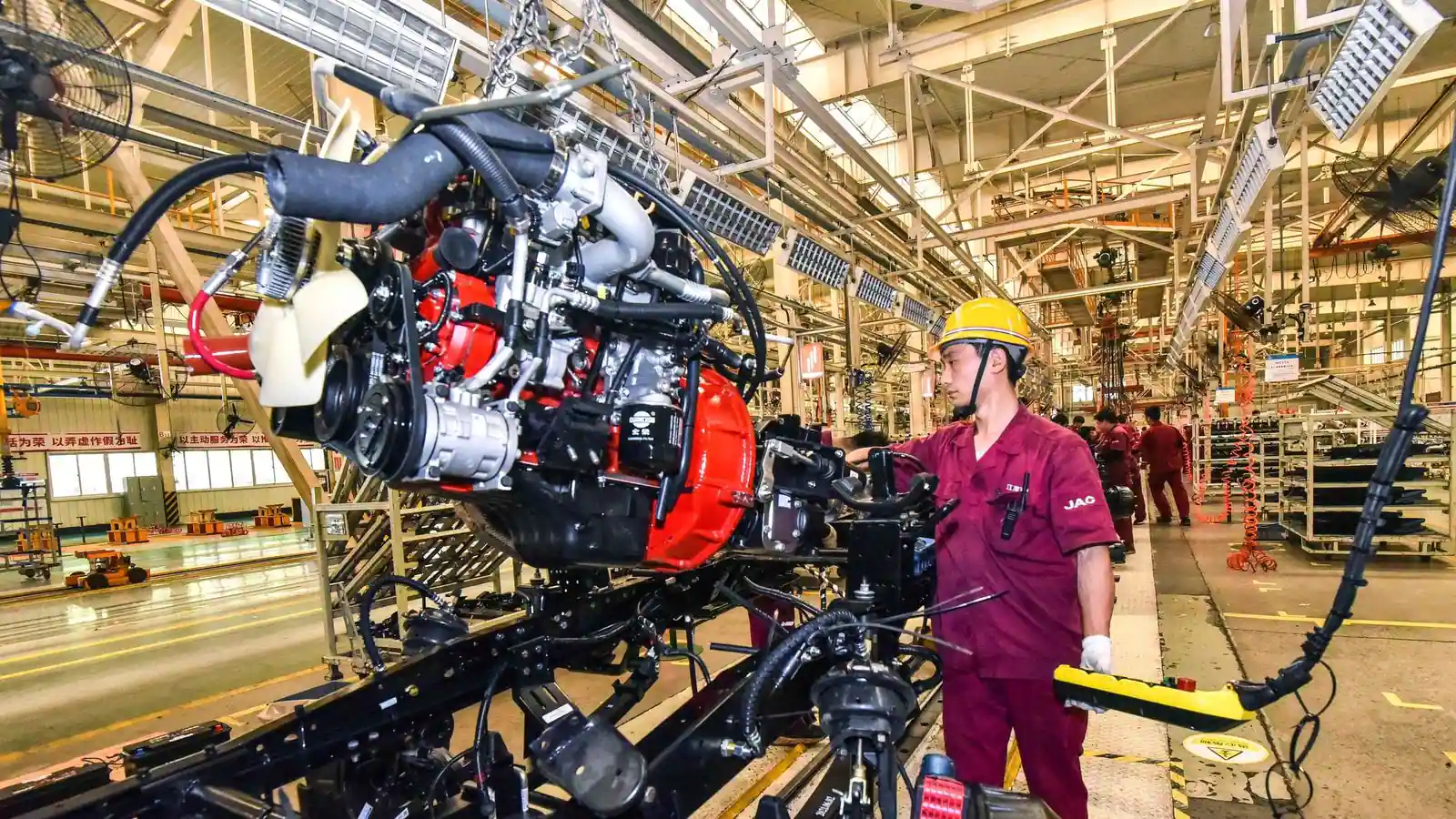

Because of expensive raw materials and supply bottlenecks, Chinese industrial companies raised their prices sharply in October.

Yazar: Tom Roberts

Yayınlanma: 11 Kasım 2021 04:50

Güncellenme: 3 Mart 2026 05:41

Chinese industrial companies raised their prices sharply in October

Because of expensive raw materials and supply bottlenecks, Chinese industrial companies raised their prices in October more sharply than they have been in 26 years. The producer prices rose by 13.5 percent compared to the same month last year, as the statistics office in Beijing announced. Economists had only expected an inflation rate of 12.4 percent, after it had been 10.7 percent in September. The producer prices are considered to be a leading indicator for the development of inflation. In the statistics, the prices are kept ex-factory - i.e. before the products are further processed or go on sale. They can use it to give an early indication of the development of consumer prices. The higher prices at export world champion China could also be felt by German consumers: Germany does not import more goods from any other country in the world, in 2020 imports from the People's Republic totaled 116.3 billion euros. In the People's Republic, inflation for consumers has so far been comparatively low, but is also rising noticeably: consumer prices rose by 1.5 percent in October compared to the same month last year, after the inflation rate in September had been 0.7 percent. "We are concerned about the passing on of producer prices to consumer prices," said Pinpoint Asset Management's chief economist, Zhiwei Zhang. The latter is likely to rise faster in the coming months as companies face empty inventory and could pass higher costs on to customers. "The risk of stagflation continues to increase," said Zhiwei. Several Chinese food companies have recently announced retail price increases as rising production costs reduce profit margins. Foshan Haitian Flavoring And Food, vinegar producer Jiangsu Hengshun and frozen food supplier Fujian Anjoy Foods have already turned the price screw. Numerous Chinese factories recently reported production disruptions. One reason for this is the shortage of electricity in the world's second largest economy after the USA. The government is accelerating the transition to clean energy, which is why old and dirty plants in particular are shutting down. Together with booming industrial demand and high raw material prices, this has repeatedly led to a standstill in factories, including those of foreign corporations such as Apple.İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...