- EUR/USD has been once again rejected from the 1.16 area.

- The dollar regains some poise and advances above 95.00.

- EMU’s Consumer Confidence coming up next in the calendar.

After testing fresh tops in the 1.16 neighbourhood, EUR/USD has embarked in a leg lower to the 1.1540, where some initial contention seems to have turned up.

EUR/USD gains capped by 1.1600

EUR/USD is now trading in the negative territory for the first time after four consecutive daily advances, although the weekly performance remains well and sound for the fifth week in a row so far. The knee-jerk in EUR/USD comes in response to a recovery attempt in the greenback, which managed to bounce off multi-month lows when tracked by the US Dollar Index (DXY) and recorded during early trade. Data wise on Thursday; the usual US Initial Claims rose by nearly 1,4 million during last week, more than initially forecasted; while Continuing Claims noted that still nearly 16,2 million Americans are benefiting from unemployment insurance. Closer to home, the flash print of the Consumer Confidence for the month of July tracked by the European Commission (EC) is due later in the session.What to look for around EUR

EUR/USD recorded fresh 2020 highs just beyond the 1.16 level, always on the back of the persistent weakness surrounding the dollar. As always, upbeat risk appetite trends continue to support the momentum around the euro in combination with the ongoing gradual economic recovery in the euro bloc. Also lending wings to the momentum around the euro, the recently clinched deal on the European Recovery Fund helped putting political fears within the region to rest (for now).EUR/USD levels to watch

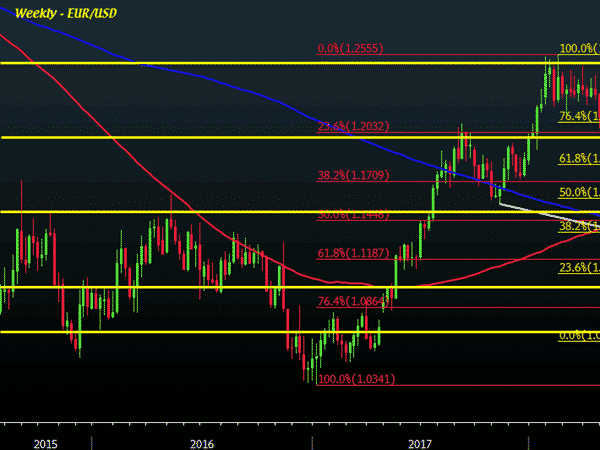

At the moment, the pair is losing 0.05% at 1.1564 and faces the next support at 1.1495 (monthly high Mar.9) seconded by 1.1448 (50% Fibo of the 2017-2018 rally) and finally 1.1422 (monthly high Jun.10). On the upside, a breakout of 1.1601 (2020 high Jul.22) would target 1.1624 (monthly high Oct.1 2018) en route to 1.1815 (monthly high Sep.24 2018). You might also be interested in:USD / CNH Continues to be a Corrective in the Short-Term

11829

0

EUR/USD loses momentum and corrects lower to 1.1540

EUR/USD loses momentum and corrects lower to 1.1540 ;After testing fresh tops in the 1.16 neighbourhood, EUR/USD has embarked in a leg lower to the 1.1540

Yazar: Zack Smith

Yayınlanma: 23 Temmuz 2020 18:54

Güncellenme: 3 Mart 2026 07:39

EUR/USD loses momentum and corrects lower to 1.1540

İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...