3256

0

If You Love Dividend Yields, Don't Miss These 2 Stocks!

Simple and Proven Business Models Allow These 2 Brave Companies to Finance Their Payments in Any Condition!

Yazar: Ross Sutton

Yayınlanma: 18 Haziran 2021 11:07

Güncellenme: 20 Şubat 2026 17:01

If You Love Dividend Yields, Don't Miss These 2 Stocks!

If You Love Dividend Yields, Don't Miss These 2 Stocks! Simple and Proven Business Models Allow These 2 Brave Companies to Finance Their Payments in Any Condition! If you expect to diversify your investment portfolio with more returns, it is worth considering these 2 stocks. Especially the recession and the rise in inflation due to the pandemic period make us think even more.1-JPMorgan Chase & Co.

Dividend Ratio: 2,2 % While JPMorgan Chase's current dividend yield of 2,2 % isn't a dizzying one, it's a healthy and acceptable income. Over the past 10 years, JPMorgan's quarterly dividend has increased from $0,25 to $0,90 per share, equivalent to an annual increase of 13,7 %. After all, this is a huge increase for a bank that depends on interest rates for about half of its income.Simple and Proven Business Models Allow These 2 Brave Companies to Finance Their Payments in Any Condition!

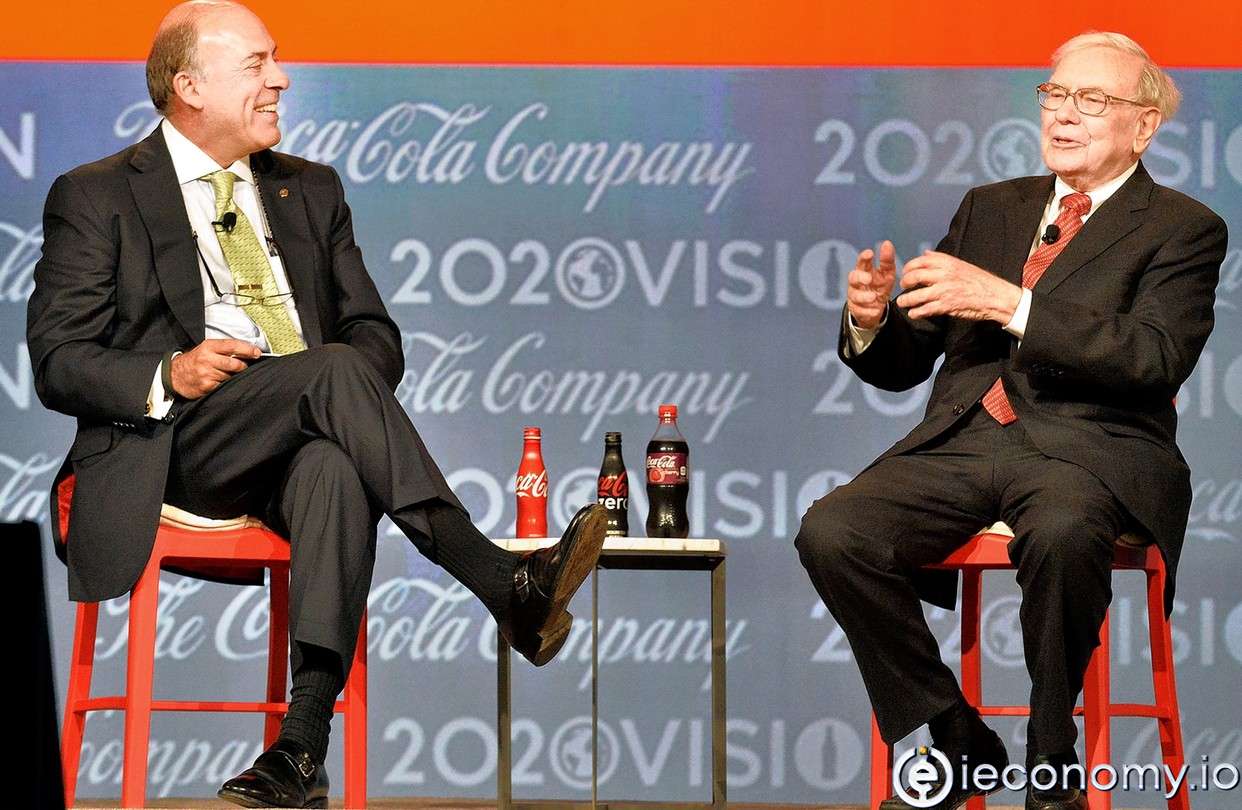

2-Coca-Cola

Dividend yield: 3 % Like most other consumer-focused companies, Coca-Cola was among the companies that were besieged by the coronavirus pandemic. Coca-Cola, whose earnings have slumped at a similar rate, slumping nearly 11% from last year's highs, is certain to find its way out of the pandemic-induced slump. As the world returns to normal, Coca-Cola tends to regain its lost market share. Simply put, Coke is stepping back from its bottling business with Franchising so it can focus more on licensing. Franchise Licensing being a much higher margin business means bigger profits are on the way. With the end of the pandemic, investors may be quite surprised at how favorable terms are set to finance Coca-Cola's dividend payments. Of course, it should not be forgotten that Coke has consistently increased the level of dividends it has been paying for 59 consecutive years, its success and its proximity to the top of the stability ranking among all dividend kings.Source: The Motley Fool

You may also be interested in:

El Salvador Launches the Clean Crypto Revolution!

İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...