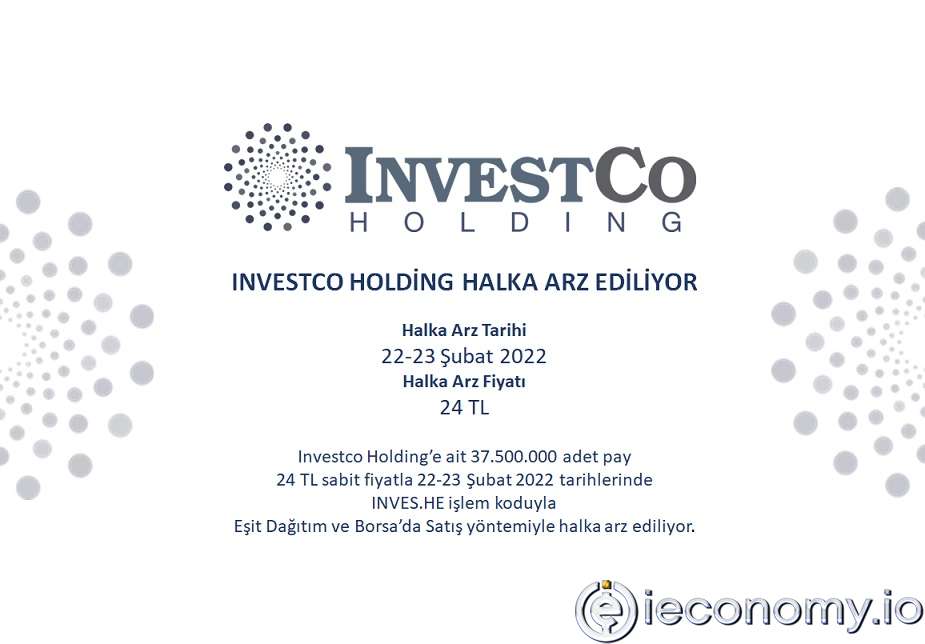

InvestCo Holding goes public

InvestCo Holding, which gathers 22 companies from renewable energy to mining, technology to food, chemistry to the health sector...

Yayınlanma: 23 Şubat 2022 01:52

Güncellenme: 3 Mart 2026 06:09

Investors will be able to send requests to all brokerage houses and banks. The demand will be collected on Tuesday, February 22 and Wednesday, February 23, with the code INVES.HE, in the supply, which will be made in the form of sales from the exchange at fixed prices and equal distribution.

All investors who want to participate in the public offering of InvestCo Holding will be able to send requests to brokerage houses and banks authorized to trade on Borsa Istanbul (BIST).

The company will increase its current paid-in capital of 150 million liras by 37 million 500 thousand liras to 187 million 500 thousand liras. The shares, with a nominal amount of 37 million 500 thousand, subject to the capital increase, will be offered for sale at a fixed price of 24 liras. All of the 900 million lira projected public offering income will go into the company's coffers.

Equity 2 billion 458 million, profit 1 billion 678 million

Planned to transfer 20% of its shares to the stock market, InvestCo Holding's net profit for the year 2021 was 1 billion 678 million liras. The equity of the company, which does not have financial debt, is 2 billion 458 million liras. After the public offering, the equity of the company will increase to 3 billion 353 million liras.

InvestCo Holding's investments include Verusa Holding, Verusaturk Venture Capital Investment Trust Inc., Pan Teknoloji, ENDA Energy Holding, and Investat Holding Limited (London-United Kingdom), renewable energy, mining, chemistry, iron ore, and steel. There are companies operating in the steel, technology, software, venture capital, food, and health sectors.

It will grow faster with new investments

InvestCo Holding, which plans to go public within the framework of the company's growth targets, will direct all the income it will obtain from the public offering to the strengthening of its investment and financial structure. In this framework, it plans to use 60 percent of it to finance new investments that will create employment in the technology and renewable energy sectors and provide foreign exchange inflows.

It aims to use the remaining 40 percent of the public offering income as capital to strengthen the financial structures that will form the basis of the company's existing investments.

In this context, InvestCo Holding aims to make significant investments in technology and software within Pan Teknoloji, which is among its current investments, and to make foreign company partnerships and acquisitions under Investat Holding Limited.

InvestCo Holding undertakes that it will not make any savings that will increase the number of shares in circulation for one year after the public offering, except for the bonus issue and dividend distribution.

InvestCo Holding will also be able to purchase up to 7,500,000 shares in order to ensure price stability for 30 days.