8290

0

Next Week's 2 Major Stocks: Microsoft and American Airlines

Next Week's 2 Major Stocks: Microsoft and American Airlines, These stocks will announce critical earnings reports next week.

Yazar: Eylem Özer

Yayınlanma: 24 Ocak 2021 22:46

Güncellenme: 3 Mart 2026 00:19

Next Week's 2 Major Stocks: Microsoft and American Airlines

Next week's two major shares: Microsoft and Airlines. These stocks will announce critical earnings reports next week.

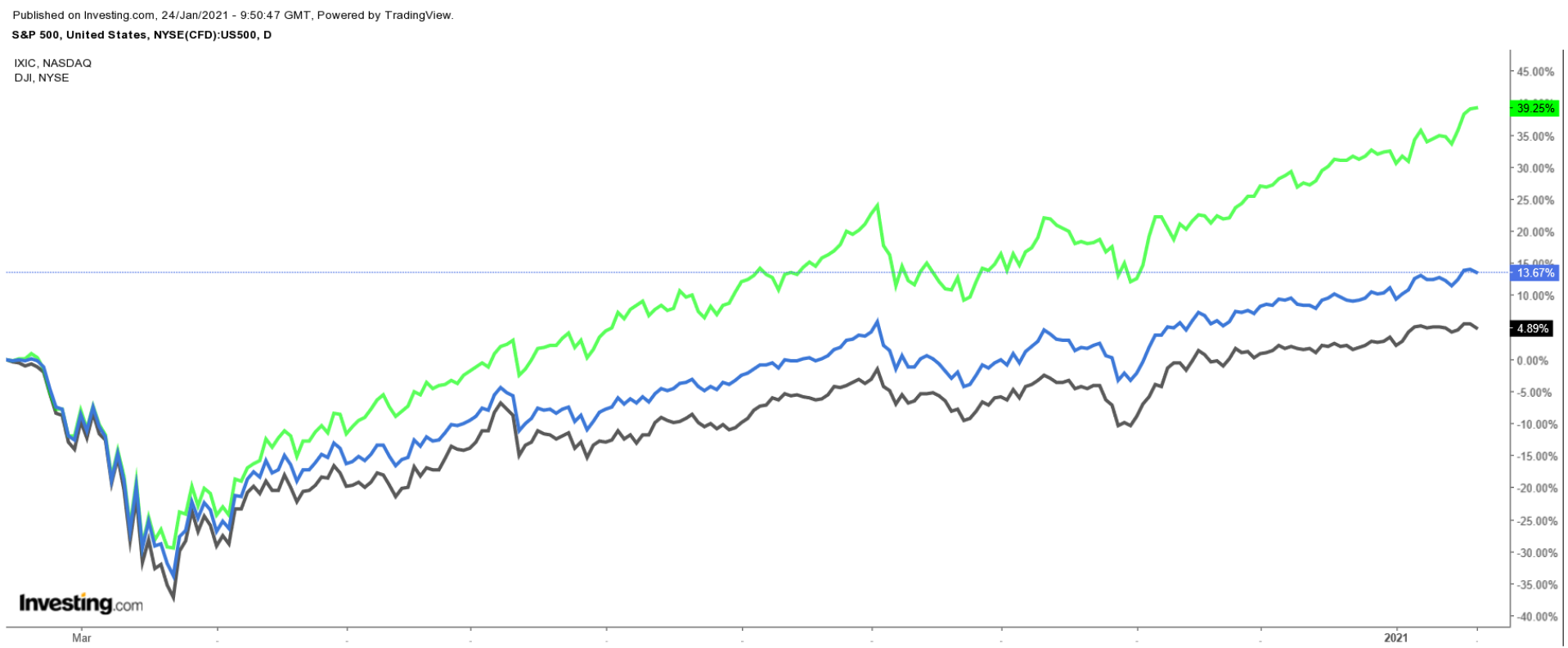

Although there was a mixed close on Wall Street on the last trading day of the week, the indices had a lucrative week despite the mixed course as the markets focused on the fourth quarter reports. The NASDAQ Composite Index gained 4.2 percent thanks to a rally in technology giants and closed again with a record. The S&P 500 and Dow Jones Industrial Average indices increased by 1.9 percent and 0.6 percent, during the same period, respectively. It is obvious that next week will be busy due to earnings reports to be announced, FED's monetary policy meeting and announcement of important economic data. However, regardless of the direction of the market, one of the two shares to be examined below is expected to lose and the other to gain.

It is obvious that next week will be busy due to earnings reports to be announced, FED's monetary policy meeting and announcement of important economic data. However, regardless of the direction of the market, one of the two shares to be examined below is expected to lose and the other to gain.

Possible Profit: Microsoft

Investors will carefully monitor the latest financial results of technology giant Microsoft (NASDAQ: MSFT), which is preparing to release its quarterly income report after the market close on Tuesday, January 26. Since the first quarter of 2017, tech giant Microsoft has been pleased or reached of Wall Street's predictions for 14 consecutive quarters. The consensus expectation is that earnings per share in the fiscal second quarter will increase by 9 percent from $ 1.51 last year to $ 1.64. Revenues are also projected to grow to over $ 40.2 billion, with an annual growth of about 9 percent, reflecting strong demand for cloud computing products. In addition, market participants will see how rapidly Microsoft's booming Smart Cloud operations continue to grow. This segment includes Azure, GitHub, SQL Server, Windows Server and other enterprise services. Another important point to note is the performance of Microsoft's Productivity and Business Processes segment. Office 365, Dynamics, Teams and LinkedIn are among the services in this segment. MSFT shares closed Friday at $ 225.95, near its record high of $ 232.86 on September 2. The stock gained about 35.5 percent in the last 12 months, surpassing the S&P 500's performance of 15.5 percent in the same period.

Technical indicators are promising and show that MSFT is ready to exit its recent trading range. Stocks again rose above the 50 and 100-day moving averages. It is stated that this situation is generally an indication that there will be additional gains in the near term.

MSFT shares closed Friday at $ 225.95, near its record high of $ 232.86 on September 2. The stock gained about 35.5 percent in the last 12 months, surpassing the S&P 500's performance of 15.5 percent in the same period.

Technical indicators are promising and show that MSFT is ready to exit its recent trading range. Stocks again rose above the 50 and 100-day moving averages. It is stated that this situation is generally an indication that there will be additional gains in the near term.

Possible Loss: American Airlines

Fort Worth, the airline's stocks could face pressure in the coming days as investors prepare for a new weak quarterly report from American Airlines (NASDAQ: AAL). American Airlines, which showed a sharp decline in revenue and profit year on year in its last quarter report, is preparing to announce its latest financial results before the market opening on Thursday, January 28. The consensus expectation was for a loss of $ 4.11 per share in the fourth quarter, compared to $ 1.15 in the same period last year. Revenues are estimated to decline to $ 3.89 billion, down 65 percent compared to the same period last year, as a result of the sharp decline in air travel during the coronavirus outbreak. In addition to earnings and earnings per share, investors will also watch carefully for an update on the company's daily cash spending amounting to $ 44 million in the third quarter. The AAL share, which recorded its historically lowest level at $ 8.26 on May 14 and decreased by more than 45 percent in the past 12 months, completed Friday with $ 15.82, giving the company a market value of about $ 10 billion.

Currently, American Airlines is the fourth largest airline in the USA.

Source: Investing.com

The AAL share, which recorded its historically lowest level at $ 8.26 on May 14 and decreased by more than 45 percent in the past 12 months, completed Friday with $ 15.82, giving the company a market value of about $ 10 billion.

Currently, American Airlines is the fourth largest airline in the USA.

Source: Investing.com

İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...