5156

0

"The SEC Should Follow Elon Musk In Terms Of Market Manipulation."

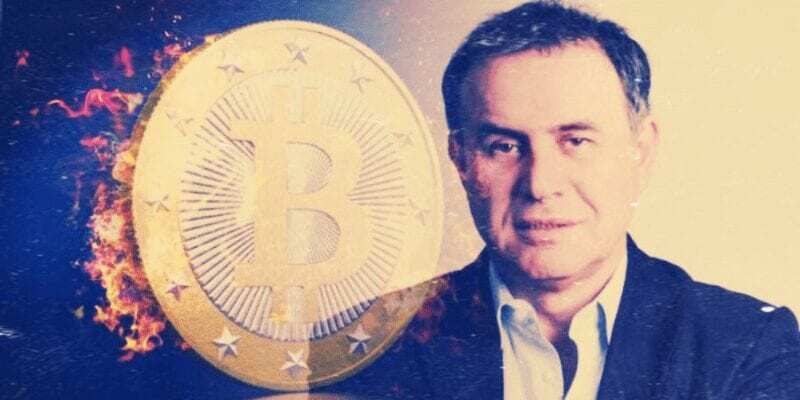

"The SEC Should Follow Elon Musk In Terms Of Market Manipulation."According to Nouriel Roubini, economist and leading Bitcoin critic

Yazar: Zack Smith

Yayınlanma: 11 Şubat 2021 21:04

Güncellenme: 19 Şubat 2026 19:47

"The SEC Should Follow Elon Musk In Terms Of Market Manipulation."

According to Nouriel Roubini, economist and leading Bitcoin critic, the US Securities Exchange Commission said that following Tesla's Bitcoin decision, it should follow Tesla CEO Elon Musk and others like him as part of market manipulation. Musk has posted supportive tweets about Bitcoin and Dogecoin in recent weeks and updated the biography of his popular Twitter profile as "#bitcoin". Tesla, in its annual 10-K report submitted to the U.S. Securities and Exchange Commission on Monday, announced that it purchased around $ 1.5 billion worth of Bitcoin (BTC, -5.76%) in January. Michael Saylor, professor of economics at New York University and CEO of MicroStrategy, has criticized the irresponsible behavior of a company with a huge trade volume of converting a significant portion of its cash reserves to Bitcoin, given the volatility of cryptocurrency.MicroStrategy currently holds 71,079 BTC, according to SEC reports released last week.

In an interview with Roubini, CoinDesk said, "This year, Tether coin (USDT) provider Tether and crypto exchange Bitfinex warned that if they were found guilty, Bitcoin could collapse." Although Tether has an outstanding market value, it is subject to numerous ongoing investigations by the US Department of Justice and the New York Attorney General's office. At the center of the U.S. Department of Justice's criminal investigation into Tether is whether USDT is used to inflate the cryptocurrency markets. Bitfinex claimed it repaid the remaining balance of the $ 550 million loan to its sister company Tether last Friday. In 2018, Bitfinex borrowed more than $ 600 million from Tether, with which it shared management and ownership. The transaction took place in April 2019 after Bitfinex claimed it lost $ 850 million of client and institutional funds at payment processor Crypto Capital Corp. Roubini predicts that the world will eventually deprecate cash and the US will create an "e-dollar". Source: https://finance.yahoo.com/ You may also be interested in this:Mastercard Will Accept Crypto Payments From Traders

İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...