10334

0

What Should We Know About the 2021 Monetary and Exchange Rate Policy?

What should we know about the 2021 Monetary and Exchange Rate Policy? Mahfi Eğilmez wrote the following.

Yazar: Eylem Özer

Yayınlanma: 8 Ocak 2021 20:53

Güncellenme: 2 Mart 2026 20:29

What Should We Know About the 2021 Monetary and Exchange Rate Policy?

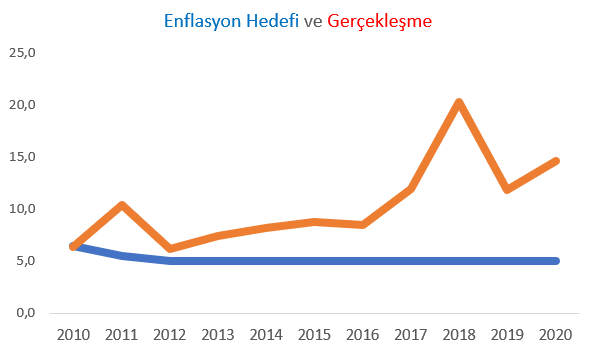

What should we know about the 2021 Monetary and Exchange Rate Policy? Mahfi Eğilmez wrote the following. Author and trader Mahfi Eğilmez analyzed the CBRT's 2021 Monetary and Exchange Rate Policy Guide for Investing.com. In the Central Bank of the Republic of Turkey’s (CBRT) Monetary and Exchange Rate Policy guide, inflation target was stated as 5 percent for the year 2021. The statements in the guide were as follows: “The upside risks to inflation require a tight and determined monetary policy stance in 2021. Monetary policy decisions will be taken by maintaining the priority of price stability.” Eğilmez says, based on these two sentences, it can be concluded that the CBRT will not reduce or even increase interest rates, at least until a relaxation in inflation is seen. According to the analysis, the most positive item of the monetary and exchange rate policy guide is the announcement of the CBRT's main policy tool as the one-week repo auction rate (policy rate). On the other hand, in the guide, it is emphasized that the interest corridor used to limit the intra-day volatility in interest rates and the Late Liquidity Window, which functions as the CBRT's ultimate lender, will not be used as monetary policy tools other than these functions. Eğilmez thinks that this is a positive step that will resolve the issue of interest rate uncertainty, which has been emphasized for a long time, and will help normalize the interest rate policy, which has gone beyond normal for a while. It is also underlined in the guide that the CBRT will effectively use required reserves and other TL and foreign currency liquidity instruments in order to ensure the correct functioning of the monetary transmission mechanism and to limit the risks to macrofinancial stability. In addition, this guide answers questions such as "Is it better to adopt a fixed exchange rate regime?" Or "Would it not be better to adopt a fixed exchange rate regime?" By answering these questions, "The floating exchange rate regime will continue, exchange rates will be formed according to the supply and demand balance under free market conditions", eliminated the uncertainties. According to the analysis, there are two important points in the guide: First, it is underlined that the CBRT does not have a nominal or real exchange rate target, and secondly, it is emphasized that the CBRT will not buy or sell foreign exchange to determine the level or direction of the exchange rates. Eğilmez states that this is the normal approach. On the other hand, he says that in the recent past, the CBRT abandoned this approach and tried to intervene by selling foreign exchange. In the analysis, which stated that making public banks a partner in this effort caused the loss of billions of dollars of foreign exchange reserves and a significant decrease in net reserves excluding swap, it was stated that this did not prevent the exchange rate increase, on the contrary, it caused a rise in the increase by causing an increase in risk. In summary, it is stated that the approaches of the 2021 Monetary and Exchange Rate Policy on issues such as interest, exchange rates and exchange rate regime are normal. However, while it is stated that these are important messages in terms of turning away from mistakes, it is emphasized that the 5 percent inflation target is also wrong. Inconsistent Goals Eğilmez uses the following statements regarding the CBRT's targets: “If you ask what is the most inaccurate target in the world, I think CBRT's inflation target will come first.” Inflation Target and Realization Apart from the holding action in 2010 (target was 6.5 percent, realization was 6.4 percent) and the approach in 2012 (target 5 percent, realization was 6.2 percent), it was not even possible to approach the 5 percent inflation target set by the CBRT and the government. After 2017, the situation turned more serious as a result of the deviations and the reflection of the external depreciation of TL. According to the analysis, despite this inconsistency, the persistent target of 5 percent in 2021 not only prevents the target from being perceived as a target, but also causes a serious loss of reputation for the CBRT and the Monetary and Exchange Rate Policy. Besides, Eğilmez points out the strangeness of this situation and says: “In addition to this weirdness, another strange situation is that the institution that gave the target soon announced an end-of-year inflation forecast far above the target. However, you either announce a target or you make a forecast. If you do both, there is no meaning to either one. Even though we criticize this for years, the CBRT will not give up insisting on repeating this weirdness.” Finally, Mahfi Eğilmez states that the return to normal steps emphasized in the 2021 Monetary and Exchange Rate Policy Guidelines could have a much stronger impact if they were combined with an acceptable inflation target. Source: Investing.comİLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...