6635

0

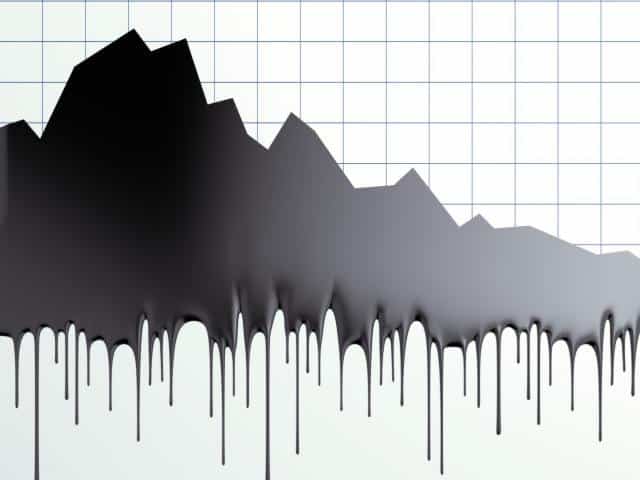

WTI remains pressured around $42.50 amid bearish OPEC report

WTI remains pressured around $42.50 amid bearish OPEC report Bearish OPEC report negates optimism over US crude stocks draw.

Yazar: Gülşah Aksoy

Yayınlanma: 13 Ağustos 2020 15:57

Güncellenme: 21 Şubat 2026 12:44

WTI remains pressured around $42.50 amid bearish OPEC report

- Bearish OPEC report negates optimism over US crude stocks draw.

- Uncertainty over US fiscal stimulus impasse dents mood.

- WTI’s downside likely cushioned by dollar weakness.

WTI technical levels

If at all the buyers manage to cross $43.25; the monthly high near $43.65 and February month’s low near $44.00 will act as additional resistances for them to confront. Alternatively; $42.30 and the channel’s support line near $41.90 precede a 200-HMA level of $41.81 to challenge the commodity bears, FXStreet’s Analyst, Anil Panchal, explained.İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...