4077

0

3 Stocks Selected by Following Peter Lynch's Footsteps

3 Stocks Selected by Following Peter Lynch's Footsteps Each of the companies we will mention below is in line with the investment logic of Wall Street legend Peter Lynch.

Yazar: Zack Smith

Yayınlanma: 27 Ekim 2020 15:21

Güncellenme: 3 Mart 2026 04:23

3 Stocks Selected by Following Peter Lynch's Footsteps

Each of the companies we will mention below is in line with the investment logic of Wall Street legend Peter Lynch.

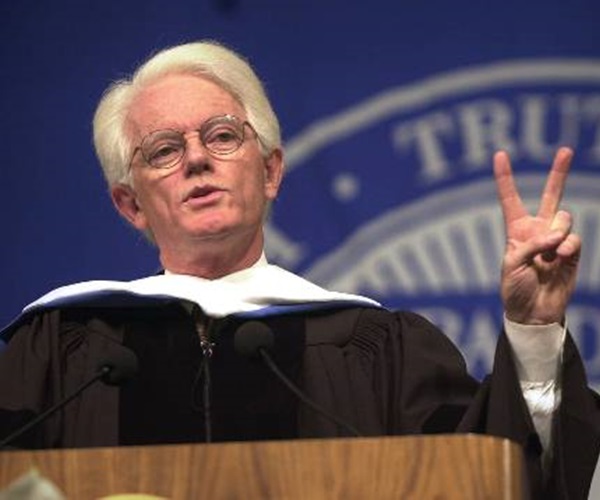

From 1977 to 1990, Peter Lynch was one of America's best-known investors as director of the Fidelity Magellan Fund. Throughout these 13 years, he has consistently performed exceptionally in the S&P 500 and achieved an average annual return of 29.2 percent for his customers. Lynch retired after leaving Fidelity. However, he continues to impress investors thanks to his unforgettable books such as “One Up on Wall Street”. In this content, we will examine three of Lynch's best-known habits and how they apply to these three stocks.

Apple

Lynch told investors "Invest in what you know." But this frequent quote doesn't just mean you blindly buy the shares of the company you love or are familiar with. It means using your information about the company as a starting point for further due diligence.

Lynch admitted in an interview with The Wall Street Journal in late 2015 that he missed several big winners after his retirement, one of which was Apple.

Lynch said that after his daughters bought him an iPod, he had to "do math calculations" to figure out how much Apple earned on each device. Apple's shares, since the launch of the first iPod in 2001; generated more than 40,000 percent in total, thanks to the launch of iPhone, iPad and other devices and services.

Apple probably won't repeat such a rise in the next two decades. However, customer loyalty towards the iPhone continues to be at high levels. The company is also aggressively expanding its extremely stubborn software and service ecosystem and increasing its revenue per user with accessories such as Apple Watch and AirPods. Wall Street expects Apple's revenue to increase by 5 percent and earnings by 9 percent. In order to achieve double digit growth rates, more 5G iPhones will need to be sold and more users will need to be on subscription-based services next year.

Best Buy

One of Lynch's messages to investors was that "You may love the stock as well as the store". The disaster for the retail industry has destroyed many chains since Lynch retired. But Best Buy (NYSE: BBY) has weathered this storm and has made an inspiring comeback in the past eight years. In 2012, customers often used Best Buy's stores as "showrooms" to test products before buying them from Amazon (NASDAQ: AMZN) or other e-commerce operations. This was the year that BestBuy's CEO Brian Dunn resigned immediately after his inappropriate relationship with an employee was exposed.

However, Hubert Joly, who came to Dunn's position, revitalized the company by embracing the "showroom" perception by revising the inventory systems that had almost collapsed, investing in the training of employees and renting space to Apple, Samsung and other popular brands to match their prices with Amazon.

Joly has also aggressively expanded Best Buy's e-commerce ecosystem and used its retail (physical) stores to fulfill online orders. Best Buy's stock rose more than 260 percent during Joly's seven-year tenure that ended last June. Corie Barry, who was promoted to the position of CEO vacated by Joly, remained loyal to Joly's strategy methods throughout the Covid-19 crisis.

Wall Street expects Best Buy's revenue to increase 4 percent and its earnings 15 percent.

Kimberly clark

Finally, Lynch told investors to "avoid hot papers in hot industries."

Kimberly Clark (NYSE: KMB), which produces paper-based products such as Kleenex, Kotex, Cottonelle and Huggies, fits this definition. It exports its products to more than 175 countries and supplies nearly a quarter of the world's population. Kimberly Clark's shares have increased by more than 190 percent over the last 20 years and outperformed the S&P 500's nearly 130 percent earnings. After factoring in reinvested dividends, Kimberly Clark generated a total return of about 460 percent. This highlights the "magic" of compound growth over the long term.

Kimberly Clark is a characteristically slow and steady growth company. However, the Covid-19 crisis increased the company's sales in the first half of 2020 in an extraordinary way. In response to the pandemic, it suspended share repurchases and postponed the end of the restructuring plan from the last quarter of 2020 to 2021. However, they resumed their buybacks in July. In addition, it continues to invest in its upward growing brands in its restructuring plan with cost cutting measures.

Analysts predicts that this year, Kimberly Clark's income will increase by 2 percent and its earnings by 12 percent. For the next year, they expect a decline to 1 percent revenue growth and 3 percent earnings growth. These short-term growth rates may appear stable. But investors looking for a "cold" long-term winner should take a closer look at this stock.

Source: https://www.fool.com/investing/2020/10/01/3-stocks-peter-lynch-would-love/

You may also be interested in:

Dow Jones Stocks To Purchase And Watch In October 2020: Apple, Microsoft Offers Latest Purchase Points

İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...