4912

0

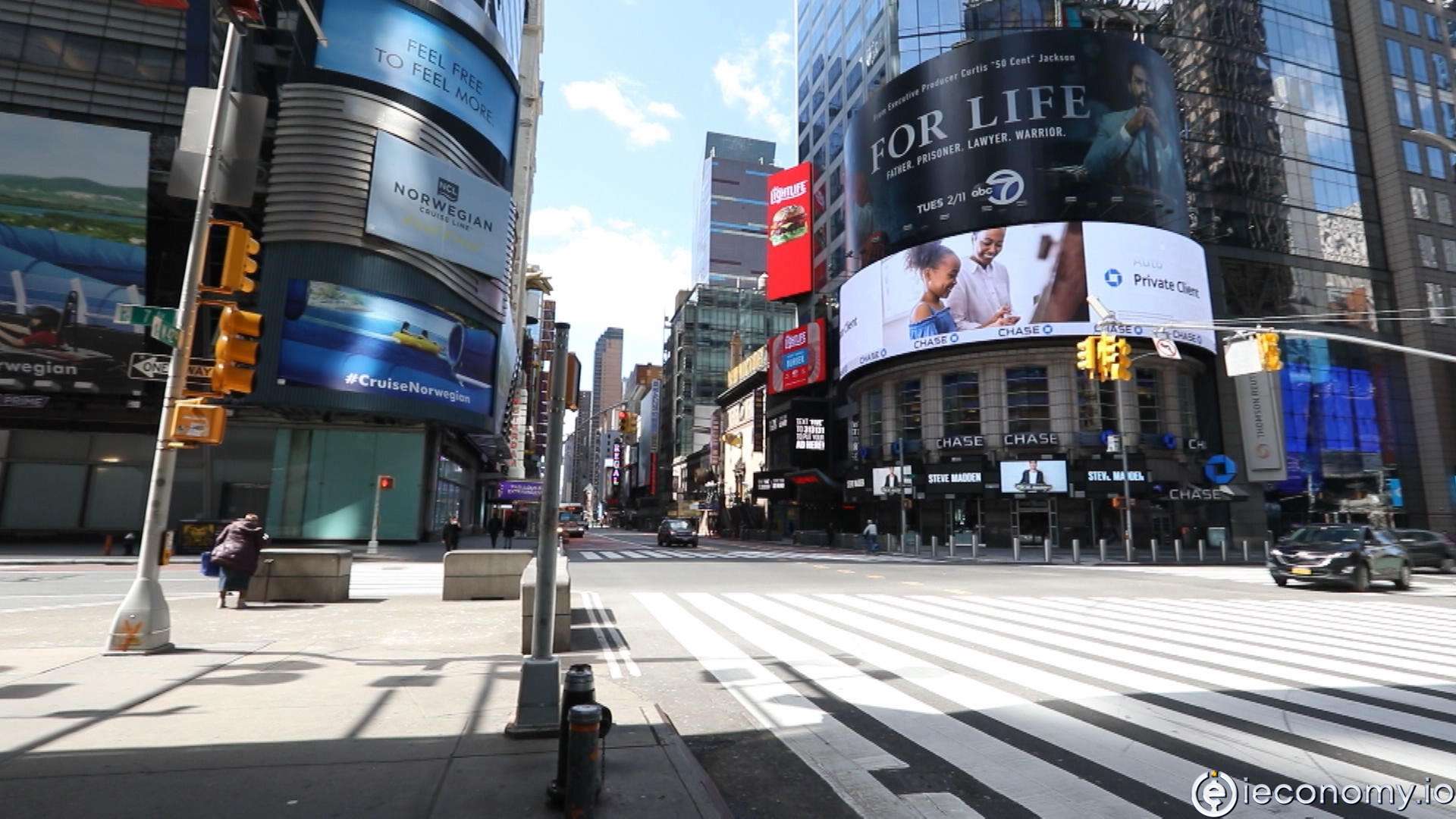

Weak labor market data depress the Wall Street

Weak labor market data depress the Wall Street. The leisure industry in particular seems to be coming under great pressure at the moment.

Yazar: Tom Roberts

Yayınlanma: 4 Eylül 2021 16:43

Güncellenme: 3 Mart 2026 06:20

Weak labor market data depress the Wall Street

Rather disappointing data from the labor market stopped the record hunt on Wall Street for the time being. The US economy missed expectations in August with poor job creation. Experts assessed the stagnating development in the leisure sector and in the hospitality industry as particularly negative. The unemployment rate fell to its lowest level since the beginning of the Corona crisis, and wages rose much faster than expected in August. The leading Dow Jones index fell 0.21 percent to 35,369.09 points. On a weekly basis, this means a minus of 0.24 percent. The S&P 500 closed hardly changed on Friday at 4535.43 points, after reaching a record high the day before. The technology-heavy Nasdaq 100, however, gained 0.31 percent to 15,652.86 points. "This labor market report will be a headache for the US Federal Reserve (Fed)," wrote Thomas Altmann of wealth manager QC Partners. With job growth far below expectations and a low unemployment rate at the same time, it is difficult to work out a clear line with a view to reducing the number of bond purchases to support the economy. As wages continue to rise faster, inflation remains a major issue. So far, at least, the Fed's ultra-loose monetary policy is still driving the stock markets. The shares of the cruise companies Royal Caribbean Group and Carnival sagged at the S&P 500 end by more than four percent each. The shares of the amusement park operator Six Flags and SeaWorld Entertainment fell by about three and a half percent each. The focus was also on fresh quarterly figures from two technology companies. The shares of the server and network service provider Hewlett Packard Enterprise lost initial profits of more than three percent almost completely and were 0.6 percent in the end. The papers of the second company, the chip company Broadcom, rose by a good one percent. Here Stacy Rasgon from Bernstein Research spoke of a solid quarter and a strong outlook for the last quarter of the financial year. In addition, the shares in the Chinese driver service broker and Uber competitor Didi rose by a good two percent. According to media reports, Didi could soon be nationalized. For a few months now, a regulatory offensive for China's tech stocks listed in the USA has been a topic of conversation again and again. The euro had only benefited more significantly from the US job data in the meantime, but then fell back again and was most recently quoted at 1.1876 US dollars. The European Central Bank had previously set the reference rate at 1.1872 (Thursday: 1.1846) dollars. The dollar cost 0.8423 (0.8442) euros. The futures contract for ten-year Treasuries (T-Note-Future) fell 0.12 percent to 133.38 points. The return on ten-year government bonds was most recently 1.32 percent.İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...