6686

0

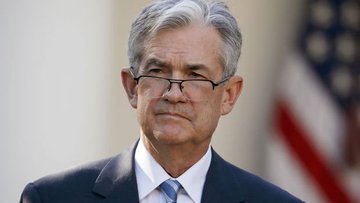

FED Economists Are Worried About Financial Risks

Fed economists are worried about financial risks. Economists seem more pessimistic than President Powell. Here are the details..

Yazar: Eylem Özer

Yayınlanma: 18 Şubat 2021 16:28

Güncellenme: 21 Şubat 2026 03:23

FED Economists Are Worried About Financial Risks

Fed economists are worried about financial risks. Economists seem more pessimistic than President Powell.

At the January meeting, when the US Federal Reserve (FED) interest rate decision was made, FED economists painted a more pessimistic picture compared to President Jerome Powell. According to the January report, FED economists described the financial risks as 'significant' in their presentation to the Federal Open Market Committee. Speaking to reporters after the rate decision on January 27, Powell described financial risks as 'moderate'. According to a FED official with knowledge on the matter, President Powell generally agrees with the work of economists. It is stated that the FED's assessment of financial stability risks is important as it determines the bank's monetary policy stance and its approach to financial regulations. It is stated that if weaknesses in the financial system increase, policy makers can tighten the rules for banks and even increase borrowing costs. FED officials did not give a signal in the reports that they would withdraw their support for the economy and stock markets affected by the epidemic in the short term. According to the report, FED members estimate that it will take some time to withdraw from asset purchases once the conditions are met. On the other hand, according to FED followers, if the coronavirus vaccine becomes widespread and the economic recovery accelerates in parallel, asset purchases may be reduced this year. In addition, FED economists stated in the detailed presentation that "pressure on asset valuation has increased", pointing out that there are financial risks. Thanks to the FED support, the S&P 500 stock index rose 75 percent from the lows in March. Private sector bond yields declined, while the average yield on the riskiest bonds fell below 4 percent. Source: Bloomberg HTİLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...