4786

0

The Period of Second-Quarter Reports Is About To End

The period of second-quarter reports is about to end. So far, the data has managed to exceed many expectations.

Yazar: Eylem Özer

Yayınlanma: 8 Ağustos 2021 18:29

Güncellenme: 2 Mart 2026 23:03

The Period of Second-Quarter Reports Is About To End

The period of second-quarter reports is about to end. So far, the data has managed to exceed many expectations.

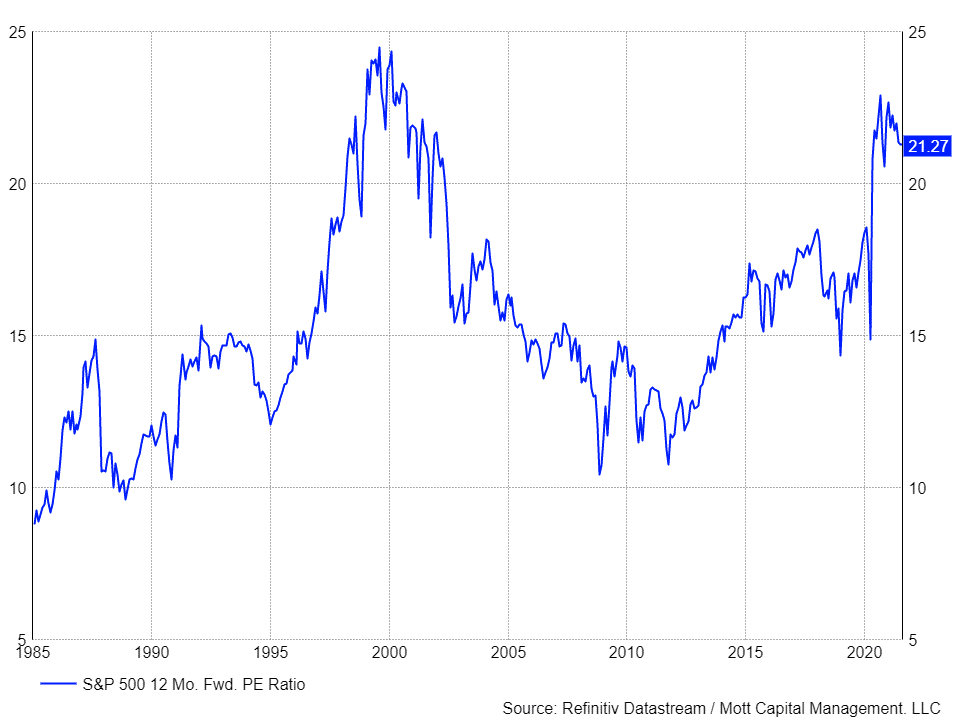

Near the end of the second-quarter reports, analysts raised their earnings estimates for the S&P 500 Index. The index has traded at the highest earnings rate in more than 20 years. The S&P 500 was trading at 21.3 times its 12-month earnings forecast on the last trading day of last week. That's an extremely high valuation, comparable only to the late 1990s. The price-earnings ratio has been supported by a strong earnings growth rate up to this point and the Fed's easy money policy. However, growth rates are expected to slow down in the coming periods, and as the US economy continues to improve, it is likely that the FED will shift to a tighter policy. [caption id="" align="alignnone" width="960"] Kaynak: Investing.com[/caption]

Kaynak: Investing.com[/caption]

Were the Gains Strong Enough?

Earnings growth soared in 2021 as the US exited restrictions imposed over the coronavirus outbreak. This development and easy monetary policy helped boost the S&P 500, increasing the index's price-earnings ratio. But the revisions to 2022 earnings were not strong enough to help bring the price-earnings ratio down to the more reasonable and sustainable level of around 17, seen before the outbreak. Most of the earnings revisions were made towards the end of 2021, rather than towards 2022. Therefore, in 2022, growth is expected to slow dramatically and rise only 9.5%. This also means that the 12-month forward earnings estimate will ultimately reflect 2022 earnings per share estimates of $213.35, giving the index a price-earnings ratio of 20.7. Therefore, strong second-quarter results do not appear to have helped enough to raise earnings forecasts for 2022 to lower the index's valuation. If revisions to 2022 earnings do not start to increase significantly, the index will face a slower earnings growth rate and a more hawkish FED as it trades at its peak price-earnings ratio. That could complicate things for the S&P 500 as it moves into the last four months of 2021 and investors are considering exactly how much they're willing to pay for the gains. This article has contributions of Investing.com.İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...