7903

0

These 5 stocks are now directing the US market

The five largest stocks on Wall Street represent an unprecedented share in the entire US market, and we know how it came about.

Yazar: editor_1

Yayınlanma: 27 Haziran 2020 16:25

Güncellenme: 3 Mart 2026 04:26

These 5 stocks are now directing the US market

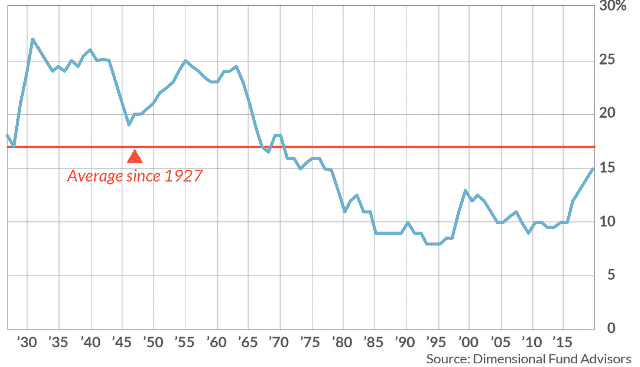

The five largest stocks on Wall Street represent an unprecedented share in the entire US market, and we know how it came about. Don't worry about such a heavy market. The current market share of the five largest stocks is actually below the long-term average of the market. The top five shares by market value are currently Microsoft MSFT (-2.00%), Apple AAPL (-3.07%), Alphabet GOOGL (-5.45%), Amazon.com AMZN (-2.24%) and Facebook FB (-8.31%) . The problem with comparing this market with the internet boom is that the argument doesn't go back enough. Although the five largest stocks now represent a larger share of the total market in the past two decades, this share is much lower than in previous years. The data is from Dimensional Fund Consultants and in the chart below. Since 1927, the average of the total stock market share, represented by the top five stocks, is 17%. This means that the most recent value is slightly below the long-term average. As the firm states, “It is not new that a small subgroup of companies have a large share in the stock market. This is not a new normal; it is an old normal. " Of course, the fact that we're seeing right now doesn't mean it's a sign of market health.

This means that we cannot draw any conclusions about the possible future returns of exchanges from the market share invested in the five largest stocks in the future. Since the 1990s, if only the data were looked at, a different result would be achieved. However, this raises the need to look at as much historical data as possible while trying to make inferences for the future.

Unfortunately, we are not in a position to be optimistic about the performance expectations of the largest companies. The DFA study revealed that after becoming one of the top 10 companies, their average stocks were delayed in the market for 5-10 years.

The meaning of both results means that over the next decade, other stocks will replace the current top five. This is "creative destruction", which is the hallmark of capitalism. The S&P 500 was the largest in the first six years of this century. In the past four years, it has lost 77% of its stock value, and now the S&P 500 is the 65th largest company.

Of course, the fact that we're seeing right now doesn't mean it's a sign of market health.

This means that we cannot draw any conclusions about the possible future returns of exchanges from the market share invested in the five largest stocks in the future. Since the 1990s, if only the data were looked at, a different result would be achieved. However, this raises the need to look at as much historical data as possible while trying to make inferences for the future.

Unfortunately, we are not in a position to be optimistic about the performance expectations of the largest companies. The DFA study revealed that after becoming one of the top 10 companies, their average stocks were delayed in the market for 5-10 years.

The meaning of both results means that over the next decade, other stocks will replace the current top five. This is "creative destruction", which is the hallmark of capitalism. The S&P 500 was the largest in the first six years of this century. In the past four years, it has lost 77% of its stock value, and now the S&P 500 is the 65th largest company.İLGİLİ HABERLER

European stocks soared and focus shifted to German retail sales after Powell's speech!

Forex Signal For TRY/USD: Inflation Slowdown in November.

Forex Signal For GBP/USD: Bullish Trend Still Not Breaking While Recovery Continues.

Forex Signal For EUR/USD: Starry US Data Points to Higher Fed Increases.

Forex Signal For BTC/USD: Downside Continues as Bitcoin Recovery Moves Less.

En Popüler Haberler

Yorum Yap

Yorumlar

Henüz yorum yapan yok! İlk yorumu siz yapın...